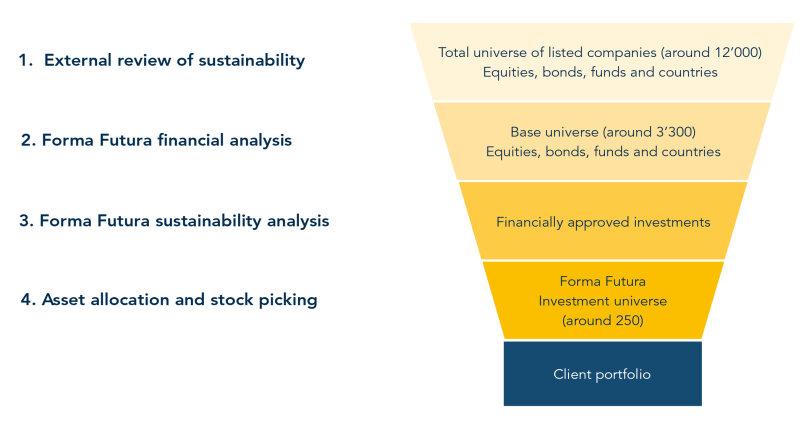

Investment Selection Process

Our clients' assets are invested in companies that make a positive contribution to a sustainable economy and society and generate a normal market return. A multi-stage selection process leads to the Forma Futura investment universe. From a global pool of over 12,000 companies, around 250 meet our strict criteria.

Forma Futura Investment Selection Process

1. External Sustainability Screening

For the first external sustainability filter, we obtain data from our research partner ISS ESG. ISS ESG uses around 100 industry-specific sustainability criteria for its evaluation. Only companies with prime status, i.e. with a good absolute sustainability performance, are preselected from this overall universe.

2. Forma Futura Financial Analysis

New: Companies that make it through the external sustainability screening and do not violate any exclusion criteria are subjected to a financial analysis by the portfolio management team. Only companies that appear to be financially attractive investments are taken to the next stage of the selection process.

3. Forma Futura Sustainability Analysis

If the findings of the external sustainability screening and the financial analysis are positive, our sustainability analysts carry out a comprehensive qualitative sustainability analysis of the companies. This is where our proprietary sustainability approach comes into play in order to identify the companies that make a positive contribution to a sustainable economy and society. This approach consists of:

- the examination of exclusion criteria and critical issues (e.g. conventional and controversial weapons, nuclear energy, genetic engineering in agriculture)

- detailed, qualitative company analyses

- active and specific engagement with the companies

- Discussion and evaluation of the companies in the sustainability committee (sustainability team and management)

- Continuous monitoring and assessment of controversial company activities

Applying the classic exclusion criteria is standard practice for Forma Futura. Furthermore, we have defined three additional sectors - fossil energy, shale gas extraction and nuclear energy - as exclusion criteria, as they hinder the transformation to a sustainable economy. Companies that generate more than five percent of their turnover from the following business activities are not part of our investment universe:

- Weapons

- Gambling

- Pornography

- Alcohol

- Tobacco

- Fossil fuels

- Fracking

- Nuclear Energy

Seeing as companies often do not provide enough detail on their revenues, a revenue threshold of zero percent would imply a false sense of accuracy. For this reason, we apply a five percent threshold to the exclusion criteria.

In addition to our exclusion criteria, we have identified a number of critical issues that require further in-depth scrutiny. In the event of involvement in one of these critical issues, the analysts carry out a case-by-case review to determine how the company in question deals with the issue. In the event of poor handling of critical issues, a company may be excluded from the investment universe.

The sustainability team's experts take up to five working days to perform such a qualitative sustainability analysis. Our experience has shown that this amount of time is required to properly evaluate the sustainability performance of a company. In a nutshell, it is a matter of gauging the credibility of a company's sustainability commitment. This involves collecting all available information about a company, comparing it with previous data and evaluating it according to the defined criteria. Often what is left out is almost as relevant as what is reported. Careful examination of all documents is therefore essential.

The entire Forma Futura investment process is based not only on extensive sustainability criteria, but also on the many years of in-depth, interdisciplinary experience of our entire team. In addition to banking and financial expertise, our skills also include scientific, technical and social science knowledge.

In this multi-stage selection process, we combine external data and information with our own research and specialist expertise. This rigorous analysis process results in an investment universe of around 250 companies.

4. Asset Allocation and Investment Selection

The final step in the investment process is to determine the investment profile together with the client according to the client's risk capacity and risk tolerance. Based on this, we construct a tailor-made portfolio.

Would you like to find out more?

We are happy to hear from you!

christian.odermatt@formafutura.com +41 44 287 22 73

Christian Odermatt

Member of the Executive Board, Head of Portfolio Management

«Being a father of two children and jointly responsible for their future development, it is vital for me to be respectful of nature, people and animals. As Head of Portfolio Management, I find it very rewarding to be able to invest with conviction, to contribute to preserving assets and to shape the future together.»